If you thought the ongoing dip in PC sales that AMD is predicting will last into 2023 could mean falling prices of CPUs and particularly GPUs, we have some bad news. Turns out AMD has been intentionally limiting supply of its chips and plans to continue to do so.

, AMD just clung onto profitability at the end of 2022 thanks to booming server chip sales. Its PC processor and GPU sales are, according to AMD's own numbers, tanking badly.

During AMD's most recent earnings call, how AMD was adjusting its output of PC CPUs and GPUs in light of lower demand. "We have been undershipping the sell-through or consumption for the last two quarters," Su said, "we undershipped in ทางเข้า w88 ใหม่ ล่าสุด Q3, we undershipped in Q4. We will undership, to a lesser extent, in Q1."

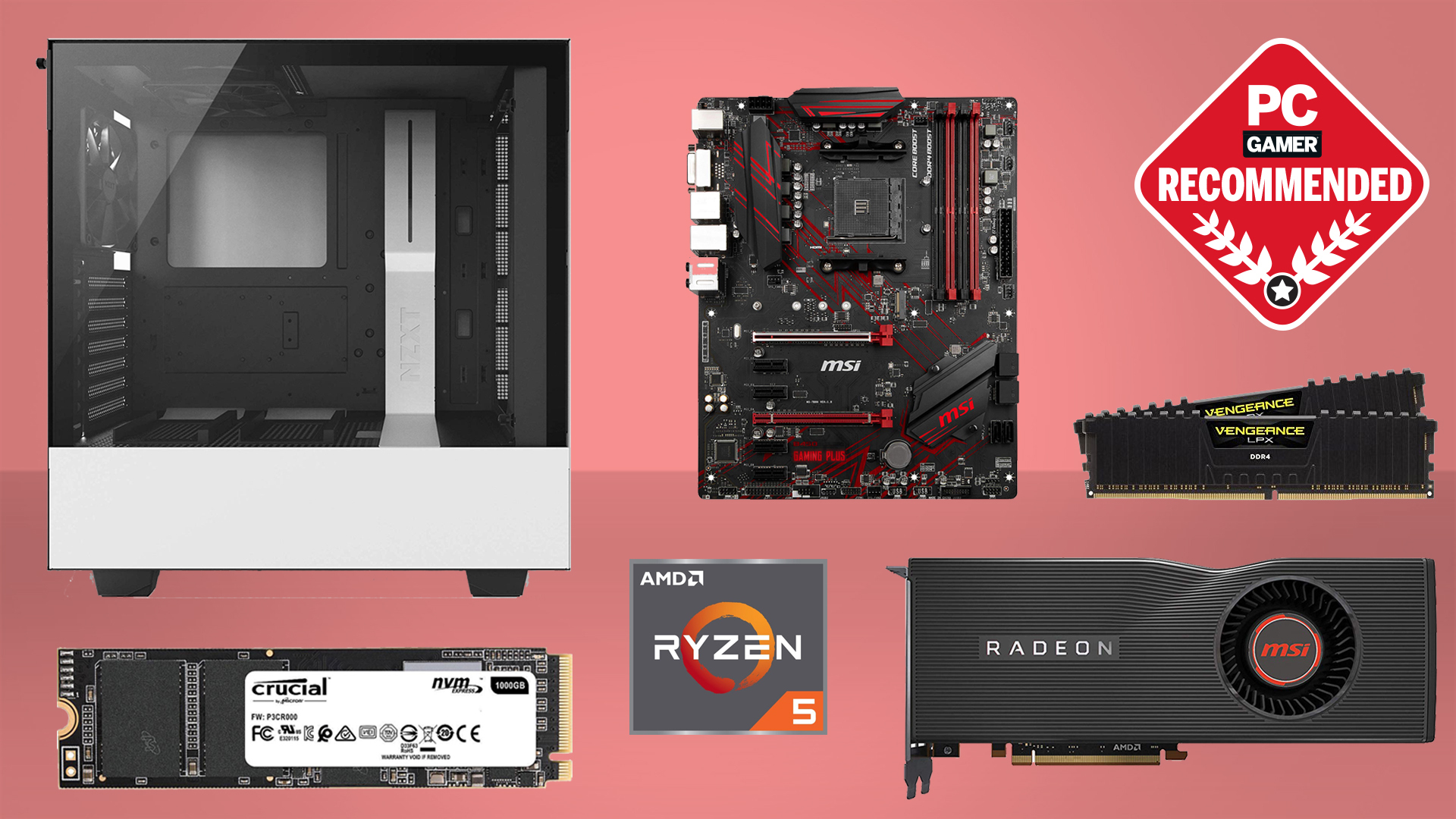

: The top chips from Intel and AMD

: The right boards

: Your perfect pixel-pusher awaits

: Get into the game bk8สล็อตฟรี ahead of the rest

Of course, you can hardly blame AMD for doing the right things to maintain profitability. Major chip manufacturers often employ these sorts of inventory management techniques to maintain an optimal balance between supply and demand. And in the long run, a healthy AMD is critical for maintaining choice and competition in the graphics market. However PIGSPIN เครดิตฟรี 100 bad things are right now regarding graphics card pricing, the situation would only be worse if AMD's main rival Nvidia had the whole market to itself.

But if you thought a big dip in PC sales and much lower demand for GPUs was going to rapidly push prices back to where they were pre-pandemic, that seems unlikely in the light of what AMD—and we suspect Nvidia—is doing to make sure supply doesn't overwhelm demand.

Moreover, this revelation from AMD's CEO helps to explain exactly how and why graphics card prices have remained stubbornly high despite the world economy entering a recession, the PC market tanking generally, demand from crypto miners disappearing and all the other factors contributing to much lower demand for GPUs.

We do still expect graphics card pricing to slowly become less painful over time. But now we know why pricing isn't—and almost certainly won't—returning to "normal". Bummer.